The fintech revolution is rapidly transforming financial ecosystems across Pakistan and the GCC, reshaping how individuals and businesses access, move, and manage money.Driven by government initiatives, evolving consumer behaviors, and cutting-edge technologies, both regions are witnessing an unprecedented surge in digital payments, digital banking, and innovative financial services.

Understanding the underlying platforms, regulatory landscapes, and growth opportunities is essential for anyone looking to build or expand in this dynamic sector.

This article provides a structured, practical roadmap to the fintech architecture, processes, and opportunities shaping the future of finance in Pakistan and the GCC.

What is Fintech?

Fintech (Financial Technology) refers to the integration of technology into offerings by financial services companies to improve their use and delivery to consumers. It includes digital banking, payments, lending, investment platforms, insurance tech, and more.

Basic Structure of Fintech

1. Core Components

- Digital Payments (e.g., wallets, QR payments, POS, remittances)

- Digital Banking (e.g., Neo banks, mobile-only banks)

- Lending & Credit Scoring (using alternative data)

- Insurtech (digital insurance processes)

- WealthTech (digital investment platforms)

- Blockchain & Crypto (limited but growing in GCC)

2. Stakeholders

- Customers

- Banks and Traditional FIs

- Fintech Startups

- Regulators (SBP in Pakistan, SAMA in KSA, CBUAE in UAE)

- Payment Gateways & Infrastructure Providers (Visa, Mastercard, Paymob, Checkout.com)

Key Processes in Fintech

- Onboarding & KYC

- eKYC, biometric verification, document upload

- Integration with NADRA (in Pakistan), Emirates ID (in UAE)

- Payments Processing

- Card-based (Debit/Credit)

- QR Code (Raast in Pakistan, Mada in KSA, NAPS in Qatar)

- Wallet-based (Easypaisa, JazzCash, Apple Pay, STC Pay)

- Transaction Monitoring

- AML (Anti-Money Laundering) compliance

- Real-time fraud detection

- Fund Settlement

- Clearing and settlement via national payment networks or banks

- Customer Support

- In-app chat, AI bots, WhatsApp integrations

Fintech Architecture (Simplified)

[User App / Web Interface]

|

v

[API Gateway / Middleware Layer]

|

+–> KYC Verification (NADRA, ID Services)

+–> Payment Processor (Stripe, Checkout, PayFast)

+–> Core Banking System (Temenos, Mambu, Custom Build)

+–> Notification Systems (SMS, Email, WhatsApp)

+–> Reporting & Analytics (Google Data Studio, Power BI)

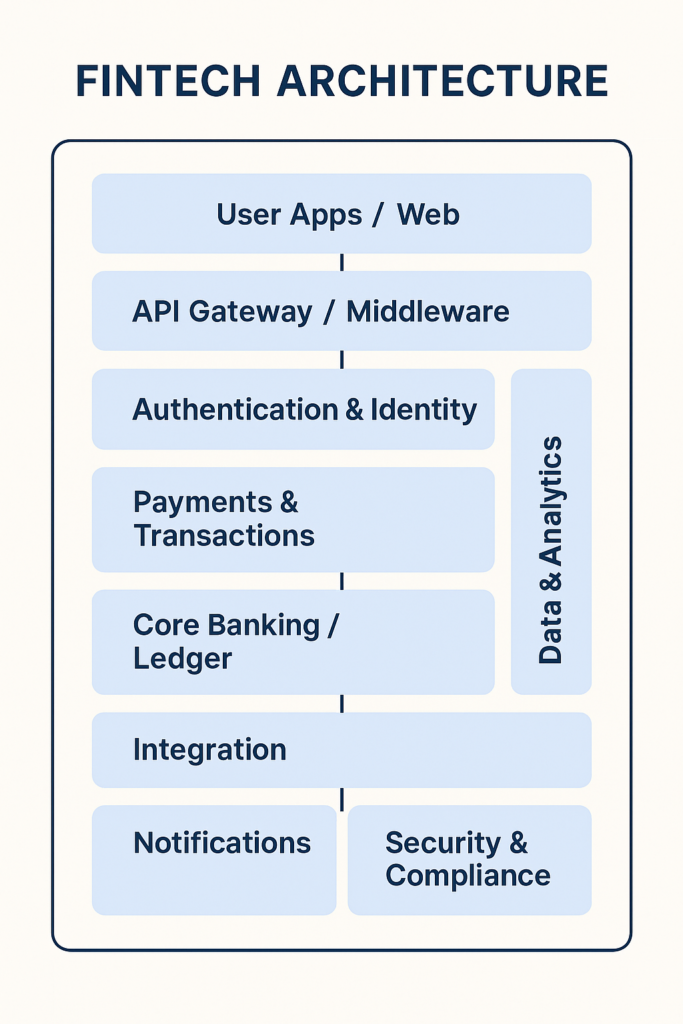

Fintech Architecture – Detailed Overview

Fintech architecture is typically modular, API-driven, and built for scalability and security. Here’s a layered breakdown:

1. User Interface Layer (Frontend)

- Mobile Apps (Android/iOS)

- Web Applications (for customers, merchants, admin)

- Chatbots & WhatsApp Interfaces

🔧 Tools: Flutter, React Native, Next.js, HTML/CSS, BotPress

2. API Gateway / Middleware Layer

Acts as the central nervous system, managing communication between frontend and backend.

- API Management (rate limiting, throttling, monitoring)

- Authentication & Security (OAuth, JWT tokens, SSL encryption)

- Routing to Services (KYC, Payments, Banking, Notifications)

🔧 Tools: Postman, AWS API Gateway, Kong, Apigee

3. Authentication & Identity Layer

- eKYC APIs – NADRA, Emirates ID, or 3rd parties like ShuftiPro

- Biometric/Face ID – Integrated with mobile apps

- OTP/2FA – For transaction approval and login

🔧 Tools: Auth0, Firebase Auth, Twilio Verify, Okta

4. Payments & Transactions Layer

This layer handles actual money movement:

- Card Payment Processors (Visa, Mastercard, UnionPay)

- Wallet APIs (Easypaisa, STC Pay, Apple Pay)

- QR Code Engines (Raast in Pakistan, Mada QR in GCC)

- Payment Gateways (PayFast, Checkout.com, Stripe, Paymob)

🔧 Components:

- PCI-DSS Compliance

- Tokenization

- Settlement Reconciliation

- PSP/EMI Interfaces

5. Core Banking / Ledger Layer

This is the heart of any fintech dealing with money:

- Tracks balances, debits, credits

- Supports multiple account types

- Enforces business rules (limits, charges, fees)

🔧 Platforms:

- Temenos, Mambu (SaaS-based)

- Vault by Thought Machine

- Custom-built in Node.js / Python / Go

6. Integration Layer

Used to talk to external systems:

- Bank APIs – Roshan Digital, Open Banking (GCC)

- Billers / Utility Companies – via API or middleware

- CRMs – HubSpot, AppSheet, Salesforce

- AML/Compliance – WorldCheck, Dow Jones

7. Data, Analytics & BI Layer

- Real-time dashboards (sales, payments, onboarding)

- Fraud detection models

- Customer segmentation

🔧 Tools: Power BI, Google Data Studio, Metabase, Snowflake

8. Notifications & Communication Layer

- SMS, Email, Push notifications, WhatsApp updates

- Transaction alerts, OTPs, reminders

🔧 Tools: Twilio, SendGrid, Firebase Cloud Messaging

9. Security & Compliance Layer

- Encryption (data at rest & in transit)

- Audit Logs – For every financial transaction

- Compliance Reporting – For SBP, SAMA, etc.

🔧 Standards: PCI-DSS, ISO/IEC 27001, GDPR

Sample Data Flow: A QR Payment Example (Pakistan + GCC)

csharp

CopyEdit

[User Scans Merchant QR]

↓

[App Sends Payment Request]

↓

[API Gateway Verifies JWT + Routes Request]

↓

[QR Code Payment Engine Decodes Data]

↓

[Core Ledger Checks Balance]

↓

[Funds Debited from Wallet or Linked Account]

↓

[Transaction Logged + Receipt Issued]

↓

[Merchant Notified + Funds Settled via Raast/Mada]

↓

[Confirmation Sent to User + Reconciled]

Critical Platforms and Partners (Pakistan and GCC)

| Platform / Tool | Pakistan | GCC |

| Raast | Instant low-cost payments (P2P, P2M, G2P) via SBP’s Raast platform | No direct Raast equivalent; GCC uses local RTGS (Real-Time Gross Settlement) |

| 1LINK | ATM network, IBFT (Interbank Funds Transfer) switch | Similar services via UAEFTS (UAE Fund Transfer System), Mada in Saudi Arabia |

| NADRA e-KYC | Customer ID verification through NADRA Verisys | Emirates ID KYC (UAE), National ID Integration (Saudi Arabia) |

| PayFast, NIFT ePay | Online payment gateways for local e-commerce and merchants | PayTabs, Telr, PayFort (now Amazon Payment Services) for GCC online payments |

| JazzCash, Easypaisa | Leading mobile wallets for P2P transfers and merchant payments | STC Pay (Saudi Arabia), Apple Pay, Google Pay, Careem Pay (UAE) |

| UBL, HBL, Meezan Bank APIs | API integrations for payment, transfers, account opening | Open Banking APIs through banks like ADCB, Mashreq, FAB (UAE), and SAMA-regulated APIs in Saudi Arabia |

BNPL Services Baadmay Tabby , Tamara

Compliance and Regulation (Pakistan and GCC)

| Regulator | Pakistan | GCC |

| Central Bank | State Bank of Pakistan (SBP) | UAE Central Bank, SAMA (Saudi Central Bank), CBB (Bahrain Central Bank) |

| Financial Market Regulator | SECP – Regulates investment, crowdfunding, insurance sectors | DFSA (Dubai Financial Services Authority), ADGM, CMA (Saudi Capital Markets Authority) |

| Telecommunication Authority | PTA – Regulates SMS, digital communications | TDRA (UAE), CITC (Saudi Arabia) for regulating mobile-based digital platforms |

| Payment Licensing | EMI Licensing, PSP, PSO Licensing from SBP | Payment Service Provider licenses issued by Central Bank UAE, SAMA Licensing (Saudi) |

| Data Protection / Cyber Law | Drafted under PECA (Pakistan Electronic Crimes Act), now evolving further | Strict under DIFC Data Protection Law, Bahrain Data Law, and KSA Cybersecurity laws |

Key Guidelines Across Both Regions:

- Mandatory eKYC via national ID integrations

- Digital-Only Account Opening allowed under regulated frameworks

- Real-time AML Transaction Monitoring and Suspicious Activity Reporting (SAR)

- PCI-DSS and ISO27001 mandatory for payment companies

- Payment System Operators licensing needed for fintech payment rail

Opportunities and Challenges (Pakistan and GCC)

| Challenges | Pakistan | GCC | ||

| Slow Bank Integrations | Traditional banks slow in tech partnerships | Big banks cautious but improving | ||

| Cybersecurity Threats | Increasing fintech attacks (especially wallets) | Strict cybersecurity compliance, huge fines | ||

| Financial Literacy Gaps | Rural and lower-income segments need education | Expat workers segment less educated in digital finance | ||

| Cost of Compliance | High cost for AML, KYC, SBP reporting | Licensing fees and regulatory compliance are expensive | ||

| Trust Building Among Lower Income Segments | Fintech adoption low outside major cities | Language, trust, and cultural adaptation challenges | ||

As Pakistan and the GCC continue to accelerate their digital transformation journeys, fintech stands at the heart of financial innovation and economic inclusion. By understanding the critical platforms, compliance frameworks, and emerging opportunities across regions, businesses and entrepreneurs can strategically position themselves for sustainable growth.

Whether it’s enabling merchant payments, streamlining remittances, or building the next generation of digital banking solutions, the future belongs to those who invest in structured, secure, and customer-centric fintech models.

The time to act is now — to bridge markets, build trust, and reshape finance across borders.